The contribution of business-to-business (B2B) payment gateways is significant in the context of contemporary commercial systems where multifaceted and secure payments are necessary for companies of every size.

These gateways are extremely important in processing payments between companies because they aid in the securitization and the efficiency of the transaction as key b2b payment platforms that support large-scale business payments.

Therefore, this guide discusses the B2B payment gateways in detail, which include their workings, advantages, and future possibilities.

With these solutions, B2B firms proficiently manage their finances and improve the level of security of their transactions and positions in the market.

What is a B2B Payment Gateway

B2B payment gateways are online systems through which businesses receive payments from other businesses. B2B payment gateways differ from consumer payment gateways, where the target customers are individuals, in that they manage more complicated and larger volume payments than B2C payment gateways.

These gateways are crucial for the overall payment structure of a business as they allow for and facilitate the secure and effective processing of payments for goods, services, or even subscriptions.

The significance of B2B payment gateways lies in their ability to facilitate payments in a simpler, faster, and more secure manner. B2B gateways enable multiple payment methods such as credit cards, ACH (Automated Clearing House), and electronic check payments.

Using these gateways, businesses are able to better manage cash flows and lower operational expenses, while enhancing security and minimizing the chances of fraud. In any case, B2B payment gateways and B2B payment platforms are essential for building strong financial relationships between players in the same industry.

A reliable b2b online payment processor enables businesses to reduce steps in their eCommerce transactions, which enhances trust. Scaling up a business model largely involves adopting B2B payment gateways. Furthermore, these B2B payment platforms help in running the business more efficiently.

Perhaps one of the best features of B2B payment gateways is how customizable their features are. These systems are made to manage both high-volume payments and a mix of many small payments, and they will always perform efficiently.

How Does a B2B Payment Gateway Differ from B2C

B2B Payment Gateways differ from B2C gateways in several key aspects as follows:

- Transaction Volume and Value: Compared to B2C, b2b transactions typically have higher volume and value, which increases the need for proper infrastructure to meet these requirements. Businesses utilizing b2b payment gateways can manage these complexities with greater efficiency.

- Payment Terms: In B2B transactions, payment terms are usually more flexible, such as net 30 or 60. In B2C interactions, these terms are hardly used. These terms are easily managed by more sophisticated b2b payment platforms.

- Integration: ERP and accounting systems integration is often a necessity for B2B gateways for better financial management. Integration is always guaranteed when using a B2B online payment processor.

B2B payment gateways normally come equipped with reporting capabilities, support for more than one payment method, and invoicing automation. With these features, businesses can track and manage their transactions more efficiently, ensuring timely receipt of payments and prompt resolution of any discrepancies. These payment gateways are very important tools for modern businesses.

How Do B2B Payment Gateways Work

A B2B payment gateway has multiple steps that involve key operations.

- Authorization: At the start of a transaction, the gateway procures authorization from the payer’s bank prior to the payment being completed. The payment gateways for B2B transactions ensure the process is secure and efficient.

- Settlement: Upon payment authorization, the withdrawal and funds transfer from the payer’s account to the seller’s bank are initiated. The reliability of the step settlement is enhanced using b2b payment platforms.

- Reconciliation: The last step encompasses reconciling the received payment to the business’s accounts to be certain about the accuracy of the information. This phase relies heavily on a robust b2b online payment processor.

Payments and purchases in the system under consideration usually involve several parties: both banks – the buyer’s and the seller’s, the payment processors, and the payment gateway.

All of them need to cooperate to allow smooth operational transactions. B2B payment gateways connect all actors and guarantee that their transaction fluidity is ensured.

Types of B2B Payment Gateways

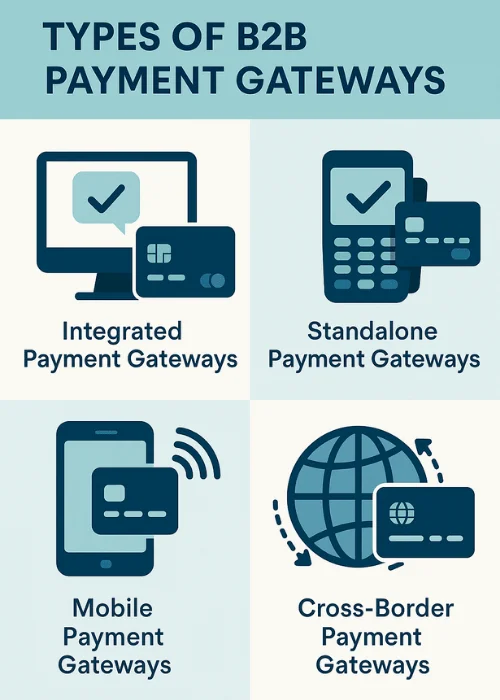

It is fundamental to note that different business types may require different types of B2B payment gateways.

- Integrated Payment Gateways: These payment gateways mechanically communicate with a company’s existing ERP or accounting system for higher efficiency in payment processing. For operational effectiveness, these types of B2B payment gateways are great.

- Standalone Payment Gateways: These separate systems are available to use by companies without having to make any changes to their internal processes. Numerous companies depend on such business-to-business payment systems for their versatility.

- Mobile Payment Gateways: Such systems support the capture of payments using mobile devices, supporting businesses that operate in volatile business settings. The use of B2B payment gateways within mobile environments increases flexibility.

- Cross-Border Payment Gateways: Such gateways allow for nonstop payment processing across countries with different currencies and regulatory compliances. B2B payment solutions and b2b online payment processors are particularly important in these cross-border situations.

Benefits of Using B2B Payment Gateways

Adopting a B2B payment gateway has its benefits, such as:

- Simplified Payment Workflow: The automation of payment processing increases efficiency while decreasing the manual workload. This is where b2b payment gateways shine the most.

- Improved Security and Fraud Prevention: Protective measures like tokenization and encryption safeguard sensitive payment details. This is a huge benefit for businesses that use b2b online payment processors.

- Effective Cash Flow Management: Payment processing has an impact on how businesses are able to manage their cash flow. This is where B2B payment platforms are incredibly useful.

- Accounting and ERP Software Integration: Integration helps to eliminate mistakes on tedious tasks like financial record-keeping. A b2b online payment processor enables smooth, integrated operations with accounting and ERP systems.

The benefits of b2b payment platforms and b2b online payment processors are voluminous and include, but are not limited to, reduced manual intervention, better efficiency, and better decision-making ability.

This sort of flexibility that people can have with b2b payment gateways ensures that corporations can stay ahead of the market and its needs. Investing in these systems is not just a matter of gaining a competitive edge but also ensuring long-term success in an ever-changing landscape.

B2B payment gateways are cornerstone tools to the vast and complex ecosystem of modern businesses. They are critical in processing transactions in a secure manner. With the emergence of new technologies, businesses are required to shift towards advanced B2B payment platforms. The corporate world has high expectations of modern online payment processors.

To meet the level of expectation, modern processors must and can easily go above and beyond, offering economically smarter and innovative solutions. In a world where business processes are heavily reliant upon precision, security, and trust, B2B payment gateways are undoubtedly the most integral financial tools.

Key Features in a B2B Payment Gateway

Businesses looking for a B2B payment gateway must look for the following critical features:

- Support for Multiple Currencies: Enables businesses to service clients in different countries through the acceptance of various currencies. Companies that do global trade must use B2B payment gateways that support multiple currencies.

- Invoicing Features: The system permits firms to build and send custom invoices professionally to their clients. This is one of the best features of most b2b payment platforms.

- Auto Reconciliation: The methodology enhances the matching of invoices with payments, thus reducing errors. The context of b2b online payment processors allows for more seamless reconciliation.

- Comprehensive Reports: Suppliers can gain a useful perspective of transaction history, which allows them to make well-versed business decisions. Suppliers who seek B2B payment gateways with detailed reporting are generally better off.

- Growth: It also means that increased transaction volume can be dealt with as the business grows. Operating and growth b2b payment platforms’ scalability is essential.

Security Measures in B2B Payment Gateways

The protection of clients is the most significant concern in B2B payment processing. Firstly, it is essential to note that an effective B2B payment gateway employs several measures to protect transactions:

- Encryption: Sensitive information can be transmitted in a safe manner. Transaction security threats are addressed by encryption protocols in b2b payment gateways.

- Tokenization: The Risk of data breaches is reduced by sensitive data being substituted with unique identifiers. Tokenization is often relied upon by B2B online payment processors for added protection.

- Fraud Detection: Fraudulent activities can be prevented and detected with the use of advanced algorithms. Robust fraud detection features on b2b payment gateways is one area businesses benefit significantly from.

- Compliance with Standards: Ensures protection of data by compliance to set industry standards such as PCI DSS. Compliance is a hallmark of trusted b2b payment platforms and b2b online payment processors.

Challenges and Considerations in B2B Payments

Businesses will reap the benefits of using B2B payment gateways, but some challenges still remain:

- Complex Pricing Models: Some businesses will find it challenging to understand and compare pricing models, especially with fees that differ based on volume and value. To avoid cost-related issues, the right b2b payment gateways pay for themselves.

- Integration Hurdles: Integration of the payment gateway with existing systems is often complex and time-consuming. Many businesses make use of robust b2b payment platforms to ease their integration hurdles.

- Achieving Regulatory Compliance: A b2b online payment processor aids adherence to cross-border payment regulations and compliance on international and domestic levels.

Business enterprises can address these problems through the measures discussed below:

- Look for Alternatives: Research the numerous and varying payment gateways on the market where your business will fall within the costs. The best B2B providers build payment gateways that are in sync with distinct business objectives that create excellent value propositions.

- Prepare to Merge: IT departments must be engaged in the entire process so that new systems work efficiently with the older ones. The integration will take place within the new b2b payment platform without any operational challenges for the business.

- Monitor Compliance: Make periodic assessments of changes to compliance policies and revise them accordingly. Regulatory compliance is easier with an established b2b online payment processor.

Tips for Successful Implementation of B2B Payment Gateway

A set of actions implements a B2B payment gateway, a successful one. This is achieved through the following:

- Specify Expected Outcomes: Set an expectation with the gateway on an improved cash flow as well as increased security. Highlighted goals will ensure maximized returns from the b2b payment gateways.

- Select and Get the Provider: The vendor should be selected based on his or her range, features, plus value to the business. Such B2B payment platforms drive productivity in the business processes.

- Adjust Systems: Make sure the adjustment is clearly defined to eliminate problems associated with the already set standards. Testing gives assurance that using the chosen b2b online payment processor will produce the expected results.

- Train Staff: Adequately prepare your team to use the new system, as this directly correlates with the efficacy of the team. Training improves the utilization of b2b transaction gateways in everyday business.

Trends and Future Outlook

There are emerging trends with the potential to disrupt the B2B payments ecosystem’s future. A number of factors contribute to that shift, such as the need for improvement in transaction processing.

- Real-Time Payments: Integration of real-time payment systems within B2B payment gateways has enabled businesses to perform transactions in real time. Hence, the demand for rapid transaction processing continues to grow.

- Blockchain Technology: Blockchain technology provides superior safety and reliability, making it favorable for use in B2B payments. This has resulted in numerous b2b payment solution providers pursuing innovations that incorporate blockchain.

- Artificial Intelligence and Machine Learning: AI and ML facilitate improvement in fraud detection as well as formulate automated solutions for complex payment systems. In addition, employing a trusted b2b online payment processor with AI capabilities guarantees secure transactions by preventing fraudulent activities.

- Adoption of Digital Payments: Digital payments are anticipated to grow, which can be attributed to advancing technologies and shifting consumer behavior. A robust b2b payment gateway will be crucial for business success.

Future Trends in B2B Payments

Many trends that are already underway will most likely continue to change the future B2B payment landscape:

- Embracing Digital Payments: The adoption of B2B payment gateways will become prevalent due to the advancement in technology and shifts in consumer trends, covering a vast array of products and services. This further exemplifies the need for reliable digital b2b payment gateways.

- Increased Integration: Interoperability will be a signature feature of the future payment solution, allowing diverse financial systems to integrate without hindrance. While complex b2b platforms will impose limitations on some companies, others will reap the benefits of streamlined b2b operations.

- Emphasizing Design: Payment gateway competition will amplify the focus on customer support and, even more significantly, an intuitive, experience-driven design. B2b processors focusing on these two aspects are likely to achieve the highest customer satisfaction when it comes to needing online b2b payment processing services.

These trends confirm how b2b payment gateways, b2b payment platforms, and b2b online payment processors will manage business transactions in the future.

Practical Integration

Integration of a B2B payment gateway into current business models can be exceedingly beneficial. This can be achieved by:

- Understanding Business Operations: Recognize and document important business operations that will interact with the payment gateway.

- Integration Using API: Connect the B2B payment gateway with existing ERP, CRM, and accounting software using APIs.

- Consistency of Information: The data is accurate and consistent across multiple systems.

- Regular Maintenance: Periodically check the integration to ensure it is up to date with the latest changes in the corporate systems and processes.

Regulatory Compliance

Ensure that all financial regulations are met when doing business in different regions. B2B payment processors facilitate compliance with regulations by achieving:

- Compliance With Norms: Subscribing to PCI DSS and other AML norms.

- Compliance Features: Providing compliance management features like transaction monitoring and reporting.

- Periodic Reviews: Carry out audits and reviews to mitigate compliance risks.

Customization and Flexibility

B2B payment processors have different forms of customization to cater to various business needs. These customizations include:

- Customizable Payment Procedures: Customizable payment processes to fit business workflows.

- Adaptable Billing: Tailor branding invoices and business requisites.

- Unified Systems: Provision of the B2B payment gateway on the cloud so that the system can be adjusted in line with the growth of the business.

User Experience and Support

B2b payment gateways depend heavily on a simple user interface as well as responsive customer service. The following are areas to be focused on:

- Easy Design: Make certain that the B2B payment gateway is friendly to both technical and non-technical personnel.

- All-round Customer service: Having customer support services available at all times in case an issue arises.

- Training Materials: Making the training materials available to the businesses so that they can reap maximum benefits from the gateway.

Costs Consideration

Familiarity with the cost structure of B2B payment gateways is extremely important for budgeting and cost management.

Key consideration costs include:

- Fees for Services: Charges that different providers might impose on a per-transaction basis, depending on the amount.

- Recurring Subscriptions: Monthly payments for the B2B payment gateway service.

- Integration Expenses: Expenditure incurred in the integration of the B2B payment gateway and the working systems.

- Support/Subscription Renewal: Recurring expenses for sustaining and upgrading the B2B payment gateway.

To limit costs, enterprises should:

- Look around: Take into account other B2B payment providers to assist them in weighing the cost against features.

- Settle Conditions: Settle Terms and charges with providers for better treatment.

- Track Transactions: Ensure that transactions and expenditures are done so as to allow for better control.

Conclusion

To sum up, B2B payment gateways bolster the flow of modern businesses by making payment processes faster, more secure, and easier to manage.

Being familiar with the functions, advantages, and disadvantages of these financial gateways can enable open-eyed decision-making and strategic financial management.

Moreover, operational efficiencies can further be enhanced through the use of b2b payment systems and proper selection of b2b online payment gateways.

It is paramount for businesses to keep track of such innovations if they not only wish to keep up with the industry, but also keep those future challenges in check.

B2B payment gateways will remain at the core of financial transactions and transform along with ever-changing B2B requirements.

If you liked this article, you can also consider reading: